are property taxes included in mortgage in texas

Total property taxes in Madison County range from 37 mills in rural areas those that are not a part of any municipality to 580 mills in Huntsville. Taxing units usually mail their tax bills in October.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Some may even require it.

. Census Bureau data to determine real-estate property tax rates and applying assumptions based on national auto-sales data to determine vehicle property tax rates. Texas depends more on property taxes than almost any other state to pay for. Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Each person who owns taxable property on Jan. The mortgage relates to. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

In District 1 which includes all areas outside of Huntsville the school millage rate is 160. House Bill 3 was an 116 billion school finance bill that included 51 billion to lower school district taxes 6. A property consisting exclusively of a one-to-four-family residence which may include a residential unit in a condominium regime.

Tax bills are due upon receipt. In order to determine the states with the highest and lowest property taxes WalletHub compared the 50 states and the District of Columbia by using US. About one-third of county property taxes go to schools with rates varying based on district.

Or B property other than property described by Paragraph A above for which the original face amount of the indebtedness secured by the mortgage on the property is less than 15 million. See how changes affect your monthly payment. 1 is liable for all taxes due on the property for that year.

Your estimated yearly payment is broken down into a monthly amount which is stored in an escrow account. Your lender then pays your taxes on your behalf at the end of the year. Most lenders allow you to pay for your yearly property taxes when you make your monthly mortgage payment.

Most property owners pay their property taxes before the years end so they can deduct the payments from their federal income taxes.

What S Included In Your Mortgage Payment To Know More Call Us On 1 800 756 0809 Or Visit Us At Www Compareclosing C In 2021 Mortgage Payment Refinance Rates Mortage

Are Property Taxes Included In Mortgage Payments Smartasset Mortgage Payment Paying Off Mortgage Faster Mortgage

Why Are Texas Property Taxes So High Home Tax Solutions

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Property Taxes 101 Understanding Your Property Tax Propel Tax

Property Tax City Of Kyle Texas Official Website

States With The Highest And Lowest Property Taxes Property Tax States Tax

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Basics Of Property Taxes Mortgagemark Com

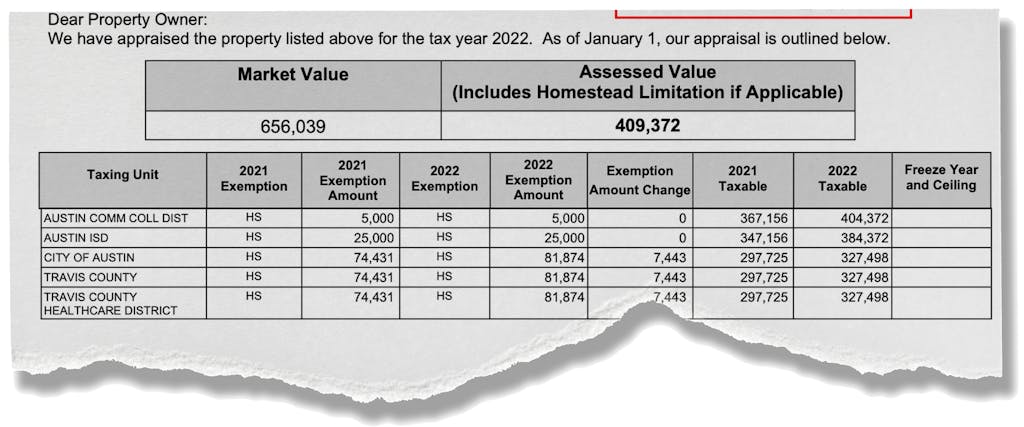

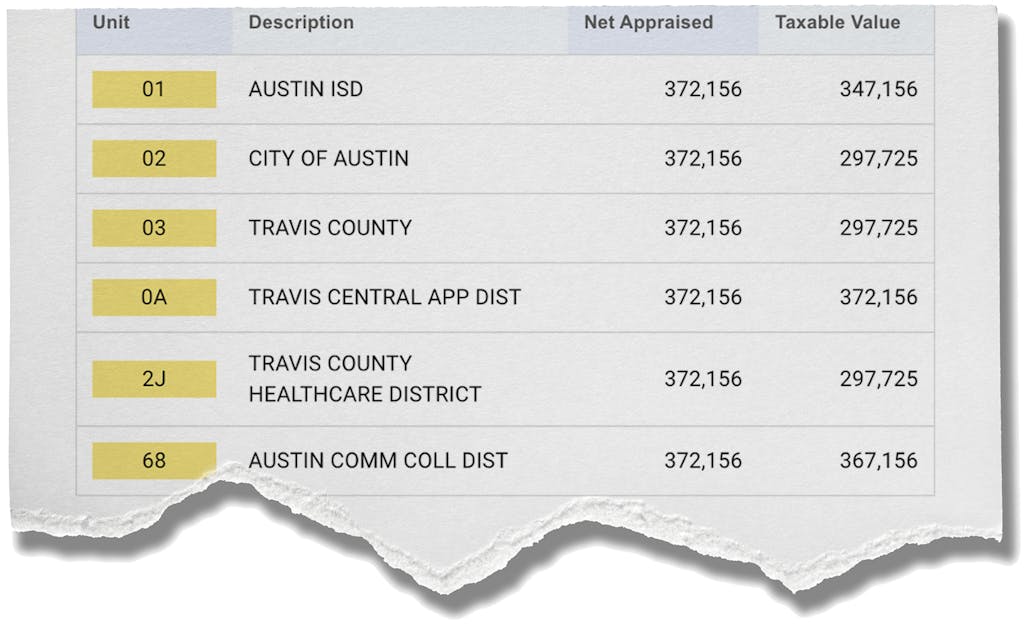

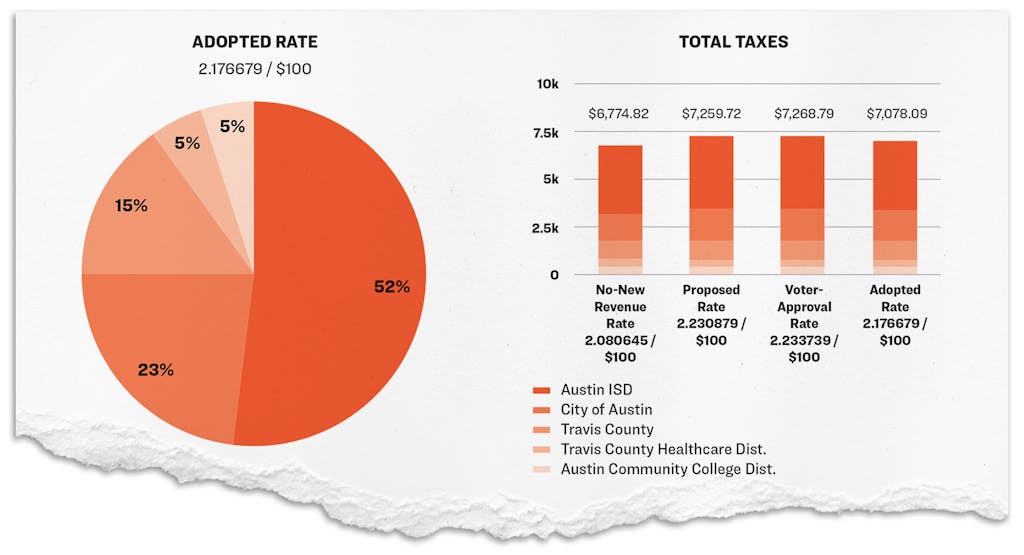

Which Texas Mega City Has Adopted The Highest Property Tax Rate

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

/https://static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

Learning More About Property Taxes In Tx Home Maintenance Learning Suburbs

Welcome To Montgomery County Texas

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)